As an American-made manufacturer, you've relentlessly optimized your production line, yet three hidden wastage points beyond your view still threaten your profitability and even your business survival.

Read MoreRecent surveys reveal that nearly 78% of U.S. consumers claim they prefer American-made clothing when given the choice, yet only 2.5% of their apparel spending goes toward domestic brands. This intention-action gap highlights a blind spot: stated preferences don’t always translate into purchases, leaving many “Made in USA” marketing dollars wasted. Apparel brand owners who don’t recognize this risk pouring resources into broad patriotic messaging that fails to drive revenue.

Hidden within the discrepancy between consumer sentiment and behavior lies an opportunity to refine messaging, tailor offers, and optimize pricing to the segments most likely to convert. By aligning marketing investments with the true drivers of purchase—age, region, income, values, and product category—brands can minimize wasted spend and unlock growth.

In the next sections, we’ll dissect generational and geographic patterns behind U.S.-made apparel purchases; explore motivations—from patriotism to sustainability—that move shoppers to act; share metrics-driven tactics to increase conversion rates with targeted messaging that turns “buy American” intent into sales.

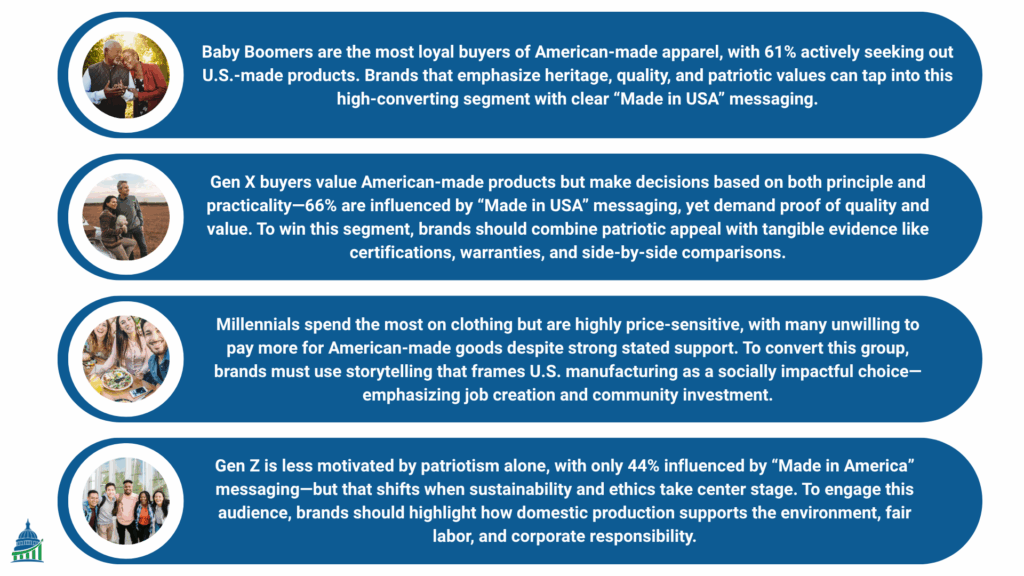

Generational differences play a major role in how consumers perceive and act on “Made in America” messaging. While older generations often see it as a badge of pride and quality, younger buyers tend to weigh other values like price, sustainability, and social impact. To effectively convert intent into action, apparel brands must tailor their approach to match the unique motivations and behaviors of each age group.

The strongest support for American made clothing comes from older generations, particularly Baby Boomers aged 55 and above. Research consistently shows that 61% of Americans aged 65 and older make a special effort to buy products made in the United States. Baby Boomers’ preference for American made goods appears rooted in both patriotic sentiment and economic concerns. Having lived through periods of American manufacturing dominance, this generation associates domestic production with quality, job creation, and national strength. For brands targeting Boomers, clear “Made in USA” badges and heritage storytelling will pay dividends.

Generation X consumers (ages 45-54) represent a middle ground in American made preferences. 66% of this demographic say “Made in America” would make them more likely to buy a product. However, their approach tends to be more pragmatic, balancing patriotic sentiment with practical considerations like price and quality. This generation came of age during the initial phases of globalization and has witnessed both the benefits and drawbacks of offshore manufacturing. They demonstrate moderate support for American made goods but are more selective in their purchasing decisions compared to Baby Boomers. They’ll pay a modest premium if the product promises superior durability or ethical labor practices, but they won’t ignore a bargain-priced competitor. Effective Gen X campaigns pair “Made in USA” with concrete proof points—third-party certifications, extended warranties, or side-by-side quality comparisons.

Millennials (ages 35-44) spent more of their budget on clothing than any other studied generation — 3.2%, but their actual purchasing behavior reveals significant price sensitivity. However, when presented with concrete price differences, their behavior shifts dramatically. The Reuters/Ipsos poll found that 37% of respondents refused to pay more for US-made goods, even though 70% of respondents said it was “very important“. Storytelling that highlights social impact (e.g., local job creation, charitable partnerships) can also tip the balance, reframing a price premium as an investment in community and sustainability.

The youngest adult consumers show the least enthusiasm for American made products purely based on country of origin. Only 44% of those ages 18-34 say “Made in America” would make them more likely to purchase a product. However, this doesn’t mean Gen Z is uninterested in domestic production. Instead, they approach it through a different lens. 73% of Gen Z customers would rather buy from brands that are good for the environment, and they’re more likely to support American made goods when framed in terms of sustainability, worker rights, and corporate responsibility rather than patriotism.

Geography plays a powerful role in shaping how consumers respond to American-made messaging. Across the U.S., regional values, economic history, and cultural identity influence whether “Made in America” resonates—or gets ignored. Understanding these regional variations allows apparel brands to craft hyper-relevant campaigns that speak directly to what matters most in each market.

Regional preferences for American made clothing show distinct patterns tied to manufacturing heritage and economic history. Two-thirds of Midwesterners (67%) say they are more likely to purchase a product when an ad emphasizes it is “Made in America”. (Source) This higher preference likely reflects the region’s manufacturing heritage and the economic impact of industrial decline on local communities. The Midwest’s strong preference for American made goods correlates with its historical role as the nation’s manufacturing heartland. States like Ohio, Michigan, and Pennsylvania experienced significant job losses as textile and apparel manufacturing moved overseas, creating both economic hardship and cultural attachment to domestic production.

For American-made brands looking to connect with Midwest buyers, the message needs to go beyond product features—it has to strike a chord with local pride, economic resilience, and shared values. The right message speaks to that history: “Built by Americans, for Americans” signals that the product is more than just a purchase—it’s a contribution to local jobs and families. Emphasizing craftsmanship over cheap imports reinforces a core belief in durability and pride of work: “Built to last. Not built to break.”

The South demonstrates strong support for American made clothing, with 61% of Southerners more likely to buy domestically produced goods. This preference aligns with the region’s significant textile and apparel manufacturing presence, particularly in states like North Carolina, South Carolina, and Georgia. The South’s support for American made clothing also reflects cultural values emphasizing tradition, patriotism, and community support. The region’s manufacturing base provides direct employment connections to domestic production, creating personal stakes in supporting American made goods.

Both Eastern and Western coastal regions show more moderate preferences for American made clothing. Eastern consumers show 60% likelihood to buy American made products, while Westerners show 57%. These regions tend to prioritize other factors like design, sustainability, and innovation over country of origin. Coastal consumers often have higher incomes and more diverse cultural exposure, leading to purchasing decisions based on multiple factors rather than nationalism alone. They’re more likely to support American made goods when they align with other values like environmental responsibility or social justice.

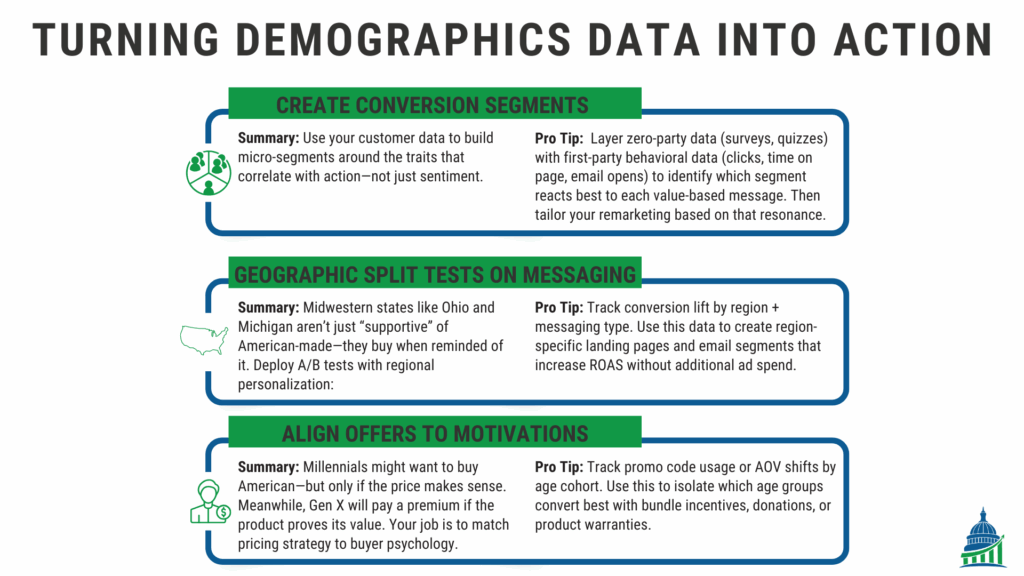

Understanding who says they support American-made clothing is a good start. But real growth comes when you dig into who acts on that preference—and why. From a data analytics perspective, the gap between stated preference (78%) and actual spend (2.5%) is a flashing red light. It signals that not all “Buy American” sentiment converts equally, and the key to unlocking sales is pinpointing who converts, under what conditions, and with which messages. Below are some actionable steps you can take to make sure your marketing dollar is well spent.

Use your customer data to build micro-segments around the traits that correlate with action—not just sentiment. For example:

💡 Pro Tip: Layer zero-party data (surveys, quizzes) with first-party behavioral data (clicks, time on page, email opens) to identify which segment reacts best to each value-based message. Then tailor your remarketing based on that resonance.

Midwestern states like Ohio and Michigan aren’t just “supportive” of American-made—they buy when reminded of it. Deploy A/B tests with regional personalization:

💡 Pro Tip: Track conversion lift by region + messaging type. Use this data to create region-specific landing pages and email segments that increase ROAS without additional ad spend.

Millennials might want to buy American—but only if the price makes sense. Meanwhile, Gen X will pay a premium if the product proves its value. Your job is to match pricing strategy to buyer psychology.

💡 Pro Tip: Track promo code usage or AOV shifts by age cohort. Use this to isolate which age groups convert best with bundle incentives, donations, or product warranties.

The “Buy American” label is a powerful lever—but only when paired with segmentation, relevance, and data-backed delivery. When your analytics are aligned with values-based messaging, your brand doesn’t just ride the wave of patriotism—it turns intent into revenue.

The gap between American consumers’ patriotic intent and their actual purchasing behavior is not a dead end—it’s a roadmap. As an American-made apparel brand owner, your job isn’t just to wave the flag louder; it’s to align your message with the right audience, at the right time, with the right motivators. Whether it’s heritage-driven Baby Boomers, sustainability-focused Gen Z, or Midwestern buyers loyal to local manufacturing, success lies in knowing who your real buyers are and what makes them move.

But knowing who isn’t enough—you also need to know what to track. Not all metrics matter equally. Broad vanity metrics will keep you guessing, while the right conversion signals will help you cut waste and scale with confidence. A great first step is downloading our free From Chaos to Clarity: DTC Metric Map, which breaks down exactly which numbers to track for each customer segment so you can start making smart, data-backed decisions today.

Q: What age group is most likely to buy American made clothing?

A: Baby Boomers (55+) are the most likely to buy American made clothing, with 75% saying “Made in America” makes them more likely to purchase and 61% actively seeking out American-made products.

Q: Do Americans actually pay more for American made clothing?

A: While 60% of consumers say they’re willing to pay 10% more for American made products, real-world experiments show significant price sensitivity. When faced with actual price differences of 85% or more, consumers typically choose lower-priced foreign alternatives.

Q: Which product categories see the highest demand for American made clothing?

A: Children’s apparel shows the highest demand for American made products (70% of parents find it important), followed by footwear and women’s wear, which represents 92% of American made apparel.

Q: Are younger generations interested in American made clothing?

A: Generation Z shows the least interest in American made clothing based purely on country of origin (44% likelihood to buy), but they’re more interested when framed in terms of sustainability and worker rights rather than patriotism.

Q: What motivates people to buy American made clothing?

A: The primary motivations are patriotic (32% want to support the U.S.) and economic (31% want to create/keep jobs), with quality perception accounting for only 13% of motivations.

Q: How do regional preferences vary for American made clothing?

A: The Midwest shows the strongest preference (67% more likely to buy), followed by the South (61%), East (60%), and West (57%), likely reflecting regional manufacturing heritage and economic history.

Q: Is American made clothing always more expensive?

A: American made clothing typically costs 17-26% more than foreign alternatives for basic items, with some products like dress shirts costing $126-$207 if made domestically versus much lower prices for imports.

Q: Do income levels affect American made clothing purchases?

A: Surprisingly, lower-income consumers show strong support for American made clothing but face practical constraints due to higher prices. The demographic skews toward lower-income earners despite premium pricing.

As an American-made manufacturer, you've relentlessly optimized your production line, yet three hidden wastage points beyond your view still threaten your profitability and even your business survival.

Read MoreBreak Open the Black Box—Unlock the Power of Sales Attribution for American-Made DTC Brands.

Read MoreUnderstanding who is likely to purchase allows you to optimize your efforts. How do you do this?

Read More