Your brand isn't just recognition—it's margin, and failing to measure its true value means leaving serious profit on the table.

Read MoreImagine this: you’ve built an incredible direct-to-consumer (DTC) product that delivers remarkable results—so good, customers can’t help but share their experiences. Take a dental implant company I’ve worked with recently; their implants not only restored smiles but sparked enthusiastic referrals from family and friends. These word-of-mouth recommendations were gold for their bottom line, yet there was a significant problem: they had zero insight into the true impact of these referrals. Why? Because they lacked a structured approach to capturing customer attribution.

Without accurate attribution, they were flying blind, making expensive marketing decisions based on guesswork rather than data. But here’s the good news—you can solve this quickly and easily with a strategic customer survey designed specifically for DTC attribution combined with your current attribution systems. In this article, I’ll break down exactly how to implement an effective customer survey so you can finally track where your best customers are coming from, eliminate hidden marketing wastage, and amplify what’s genuinely driving your revenue.

A customer attribution survey is a targeted questionnaire that asks customers directly how they discovered your product or brand. It provides critical insights that traditional attribution models often overlook, especially when it comes to measuring the influence of less tangible sources like word-of-mouth, offline marketing efforts, or multi-channel interactions.

According to Demand Gen Report, “Advancing measurement is a growing priority—86% of marketers say deeper metrics are essential to prove ROI.” Traditional attribution models, like first-click or last-click, are limited because they fail to capture the full customer journey. Eddie Casado from HockeyStack Mouseflow highlights this limitation clearly: “First-click and last-click models miss the impact of the full journey. You need influence-based or multi-touch models to allocate budget effectively.”

In short, customer attribution surveys bridge the gap between the data you currently have and the complete picture you need, ensuring your marketing budget is spent where it truly counts.

Timing is crucial for survey effectiveness. Ideally, send the survey shortly after purchase while the experience is fresh. Follow-up surveys at regular intervals (30, 60, or 90 days post-purchase) can also uncover longer-term referral insights.

Optimizing response rates requires clear, concise communication. Ensure your survey is short, focused, and easy to complete on mobile devices. Personalize your invitations and clearly state how responses will directly enhance the customer’s experience.

Increase response rates with strategic incentives, clear introductions, and thoughtful follow-ups:

Use a mix of open-ended and multiple-choice questions:

By addressing these key areas, you’ll gather actionable data to guide smarter, revenue-driving decisions.

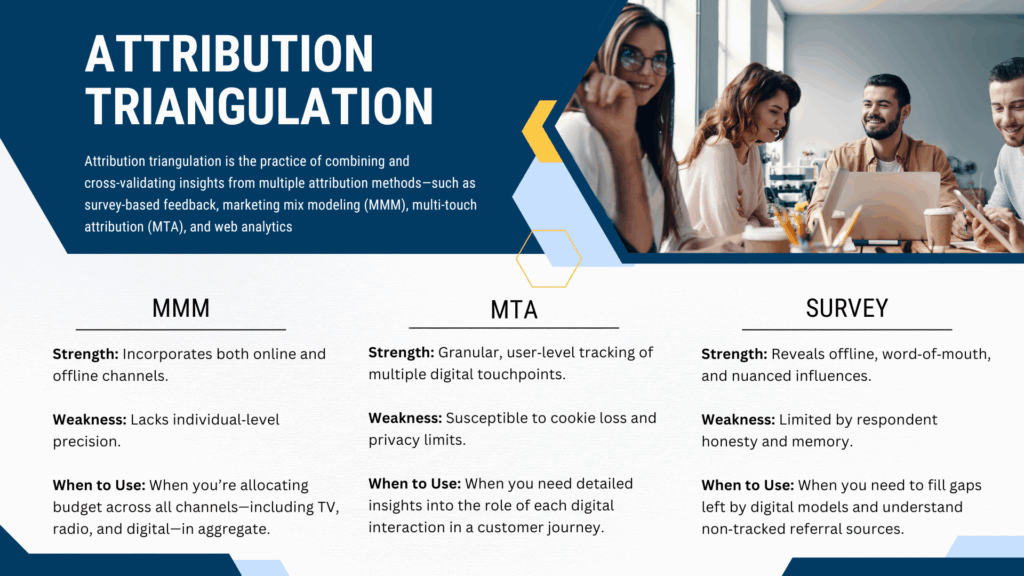

Occasionally, survey results may contradict analytics data. This discrepancy can occur due to customers’ imperfect memories or differences in tracking methods. The key is to use a triangulation approach—comparing and validating survey responses with analytics data to identify and resolve inconsistencies. For instance the client at the beginning of the article used a triangulation approach where the survey’s responses were weighted with partial credit in attributing sales.

Data triangulation involves cross-validating insights from your customer surveys with other robust attribution methodologies, such as Marketing Mix Modeling (MMM), Multi-Touch Attribution (MTA), and Google Analytics attribution models. MMM helps you understand the impact of marketing activities across channels by analyzing aggregated sales data, offering a broad perspective on effectiveness. MTA, on the other hand, provides granular insights by tracking individual customer interactions across multiple touchpoints.

Using Google Analytics’ attribution models further complements your understanding by assigning credit to various touchpoints along the customer journey based on specific predefined rules. When survey data identifies word-of-mouth or offline activities as influential, integrating this qualitative insight with quantitative models like MMM and MTA strengthens the accuracy and reliability of your marketing insights.

This comprehensive triangulation approach ensures you’re not solely dependent on any single data source, thereby significantly improving the precision of your attribution efforts.

Accurate customer attribution is the cornerstone of effective marketing, and customer surveys play a pivotal role in achieving this accuracy. By strategically implementing these surveys, integrating results with your existing analytics through data triangulation, and proactively avoiding common pitfalls, you can transform your attribution from guesswork into precision. The tangible takeaway? Commit to sending your first attribution survey this week and begin leveraging these powerful insights immediately. Remember, clarity drives profitability.

How do we prove the value of attribution surveys to leadership? Demonstrate how surveys uncover hidden insights that traditional models miss, directly linking these insights to increased ROI and more effective budget allocation.

How long before we see ROI from attribution surveys? Typically, you’ll start seeing actionable insights immediately, with measurable ROI improvements evident within 1-3 months as you optimize your marketing spend.

What survey platform is best for attribution surveys? Popular, reliable platforms include SurveyMonkey, Typeform, and Qualtrics, all offering robust integrations with marketing tools and analytics systems.

How frequently should we run attribution surveys? Run attribution surveys at key customer milestones, such as post-purchase and quarterly, to maintain up-to-date and relevant insights.

Should attribution surveys be mandatory or optional? Optional surveys usually yield better-quality responses, especially when combined with small incentives to encourage participation.

Your brand isn't just recognition—it's margin, and failing to measure its true value means leaving serious profit on the table.

Read MoreBreak Open the Black Box—Unlock the Power of Sales Attribution for American-Made DTC Brands.

Read MoreAs an American-made manufacturer, you've relentlessly optimized your production line, yet three hidden wastage points beyond your view still threaten your profitability and even your business survival.

Read More